Investing in a Classic Car Restoration: A Journey Beyond Value

Have you ever wondered what drives the vibrant world of classic car restoration? It's not just about the money — it's a passion that goes beyond dollars and cents.

Occasionally new enquirers to Finch Restorations have a misconception that our existing customers adopt strategies of capping restoration budgets at the final (restored) value of the car. In reality, very few customers adopt this approach, although it is a natural feature with high-value vehicles.

Why Passion Outweighs Price in Car Restoration

As a broad generality, the passions that drive our customers to restore a vehicle often lie within three segments:

- Collectables – our customer enjoys collecting cars of a particular marque and generally seeks a high level of authenticity. Not just cars, but pieces of history our clients cherish and preserve with utmost authenticity.

- Heirlooms – our customer owns a vehicle that, for example, belonged to a deceased parent, deceased partner, or they have owned it since their teenage years. Thus, the vehicle has been part of the family for many decades. More than a vehicle, it's a cherished memory passed down through generations, binding the past and present.

- Dreams – our customer has reached a point in their life, perhaps now an ‘empty nester’, when they can afford the car that they dreamed of having in their teens or twenties, or they want to enjoy past memories by owning a car reminiscent of what they used to drive. These are the dreams taking shape in metal and memories, fueling a passion for those elusive rides once dreamt of.

Thus, it is passion instead of speculation that drives the majority of our clients.

The Real Value of Classic Cars

If a person making a new enquiry with Finch Restorations wants to cap their restoration at the forecast final (restored) value of the car, it is often incongruous with similar decision-making the same person might make when purchasing a new car.

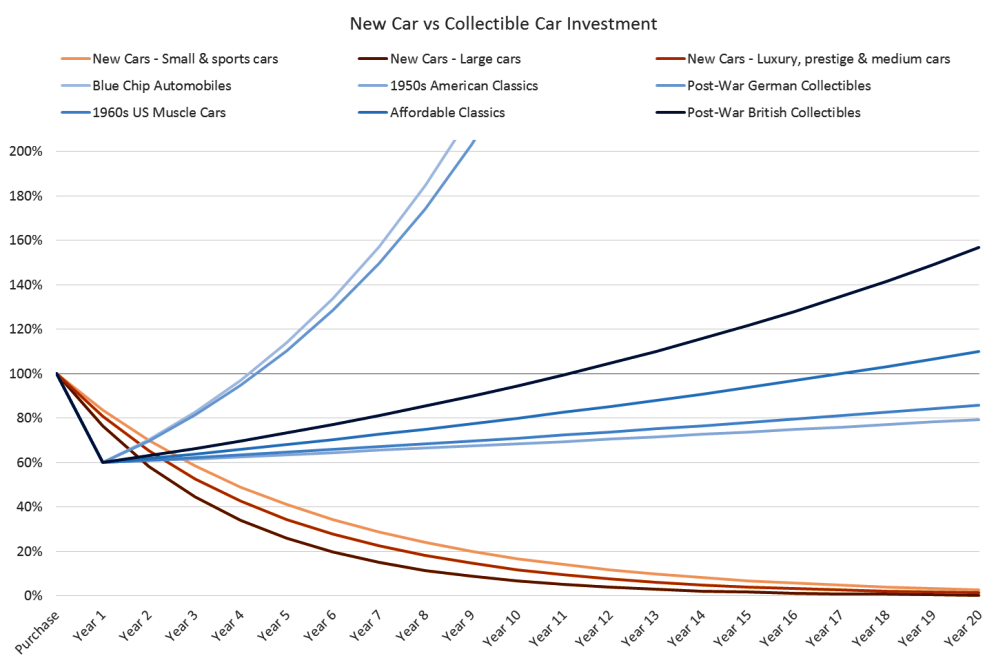

In the USA, new cars typically depreciate at a rate between 10% and 40% in the first year with the majority at the higher amount. In Australia, new cars typically depreciate at a rate between 16% and 24% every year over the first four years. Of particular interest:

- Small cars and sports cars depreciate each year at an average of more than 16%.

- Luxury cars, prestige cars, and medium cars depreciate each year at an average of more than 19%.

- Large cars depreciate each year at an average of nearly 24%.

Based on these depreciation rates, determined from ‘real world’ statistics, a brand new car purchased for, say, $100,000 will be worth on average only $60,000 after two years, and only $40,000 after four years.

On the other hand, a collectible car will be appreciating in value while the new car is depreciating in value.

Hagerty is the leading insurance agency for collector vehicles in the world and host to the largest network of collector car owners. Three times each year, they publish a stock market style index that averages the values of the most sought-after collectible automobiles in various collectible segments.

Amongst the indices published by Hagerty are the following, from which average appreciation rates for over nine years from January 2007 until January 2016 can be determined:

- Affordable Classics – averages the values of 12 undervalued cars, priced under U$30,000, from the 1950s-70s. The average appreciation rate for these cars is 3.3%. Discover the hidden gems of automotive history that promise both joy and a smart investment.

- "Blue Chip" Index – averages the values of 25 of the most sought-after collectible automobiles of the post-war era. The average appreciation rate for these cars is 17.4%. Invest in the pinnacle of automotive excellence and watch your investment grow alongside their legendary status.

- 1950s American Classics – averages the values of 19 of the most sought after collectible American automobiles of the 1950s. The average appreciation rate for these cars is 1.5%. Revel in the golden era of American automotive innovation and own a piece of cultural iconography.

- American Muscle Cars – averages the values of the rarest and most sought-after muscle cars. The average appreciation rate for these cars is 1.9%. Embrace the raw power and bold spirit of the American Muscle, a true reflection of automotive passion and performance.

- Post-War British Cars – averages the values of 10 of the most iconic British sports cars from the 1950s-70s. The average appreciation rate for these cars is 5.2%. Step into the world of refined elegance and engineering excellence with these timeless British classics.

- Post-War German Cars – averages the values of 21 of the most sought after cars from BMW, Mercedes-Benz and Porsche from the 1950s-70s. The average appreciation rate for these cars is 16.5%. Experience the unmatched precision and iconic design of German engineering through these collectible masterpieces.

Imagine if our new car buyer was instead to spend his/her $100,000 on acquiring, transporting, and restoring a collectible car that was only valued at $60,000 once completed. Within two years they would likely still have a more valuable and appreciating asset than if they had purchased a new car. After four years they would likely be $20,000 in front. Depending on the type of vehicle, they may have realised all of their original investment; this at a time when the new car has probably depreciated to $10,000.

The moral therefore is, if you are a speculator, please look beyond the basic transaction. There are many other tangible and intangible benefits available to the owner of a collectible car that are not available to the owner of a new car.

Embark on your classic car journey with Finch Restorations and experience the unrivaled joy of bringing history back to life. Contact us today!